A Comprehensive Guide to Proper Funding Reviews for Financial Growth

You might be thinking about getting loans and afraid of scams and want to know about some legal companies. However, I recently came to know that people are searching for one of the financial service companies that offer loans and everyone wants to know about its reviews. Let me shed light on the proper funding reviews the represent and also tell you about the legitimation of this company.

What is Proper Funding?

This is a financial services company. Proper Funding offers a quick and simple loan application process, with loan approval typically occurring within a few days. Proper Funding is a useful option when it comes to short-term loans. Moreover, it also offers some financial services.

The primary focus of the company is combining debt. People who have high-interest credit card debt will benefit from this. Primarily, they provide low-interest loans that don’t require any security.

Is proper funding a Legitimate Company?

We didn’t say anything about his financial company. I searched about this company and didn’t get any type of solid reviews. That’s why we didn’t recommend our users to use this site. Moreover, you can use some of the best alternatives for proper funding.

What are the Proper Funding Reviews?

Now, we will show you the different reviews of proper funding on different platforms. Have a look at them;

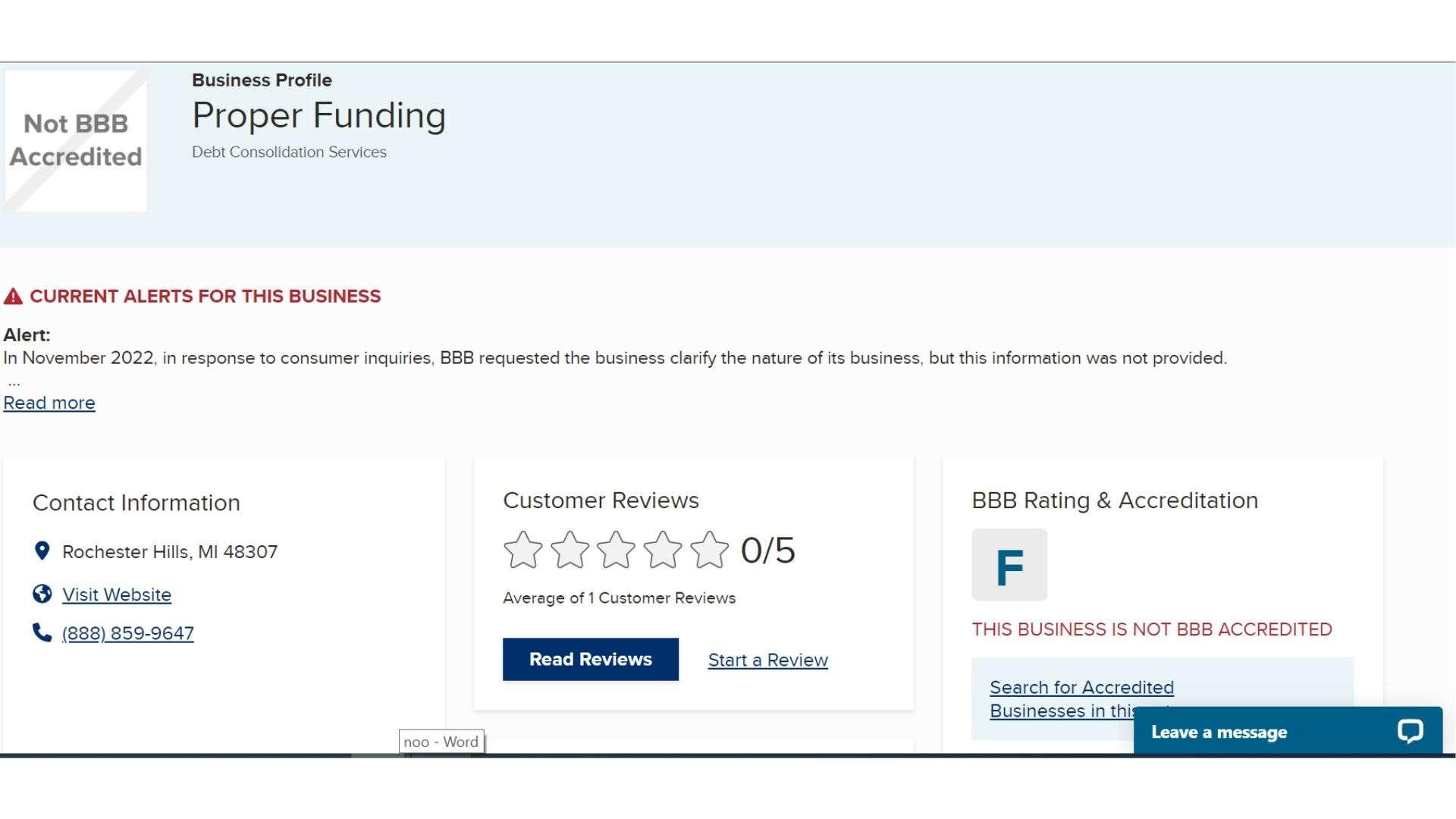

Better Business Bureau:

According to BBB, there is no review for this website is available. Moreover, when you visit BBB, you can see an alert message for this business. However, as per BBB, this business is not registered in the State of Michigan business name.

Trustpilot:

I searched and saw there are 3/5 rating reviews of Proper Funding on Trustpilot.

Proper Funding Reviews:

I also searched their official site and there is a blog present on their site that shows their customer reviews. Well, I’m going to attach some screenshots of their customers’ reviews and what they said about them.

Google Reviews:

On Google, I also searched about its reviews and found out there are no reviews present on this company. A lot of people share their own reviews that we mention above.

What is the Community Response to Proper Funding Company?

Well, a lot of people say that they receive a letter in the mail that covers all of their debt at a rate of 3.89% to 4.5%. But they also said that they were denied the loan and qualified for the debt. That’s why it is a little bit complicated to tell about the proper funding reviews.

What are the Pros and Cons of a Proper Funding Company?

In the table below, we are going to discuss some of the pros and cons of the proper funding company that you surely need to know.

| Pros | Cons |

|---|---|

| Customer-Focused Approach | Possibly Higher Eligibility Criteria |

| Efficient Loan Approval Process | Potential Impact on Credit Score |

| Unsecured Low-Interest Rate Loans | Limited Information |

| Quick Funding Disbursement | Not Suitable for Long-Term Financing |

| Debt Consolidation Specialization | Economic Factors and Market Changes |

What are the best alternatives for Proper Funding?

Here are the best alternatives for proper funding as per my observation. You can use these alternative instead of proper funding but keep in mind that first make sure that these alternative suits your preference.

- Bank Loans

- Online Loans

- Invoice financing

- Venture Capital Firms

- Partnerships

- Small-Business Grants

- Crowdfunding

- Peer-to-Peer lending

Our Reviews:

Lastly, I will tell you that my experience with Proper Funding was less than satisfactory after proper research about this company. The lack of exposure surrounding fees even if the loan approval procedure was expedited was not fair.

In my opinion, Considering Proper Funding as a financial solution should only be done after careful consideration of all conditions and costs by future borrowers. I ensure that you get your answer about proper funding reviews after reading this article.