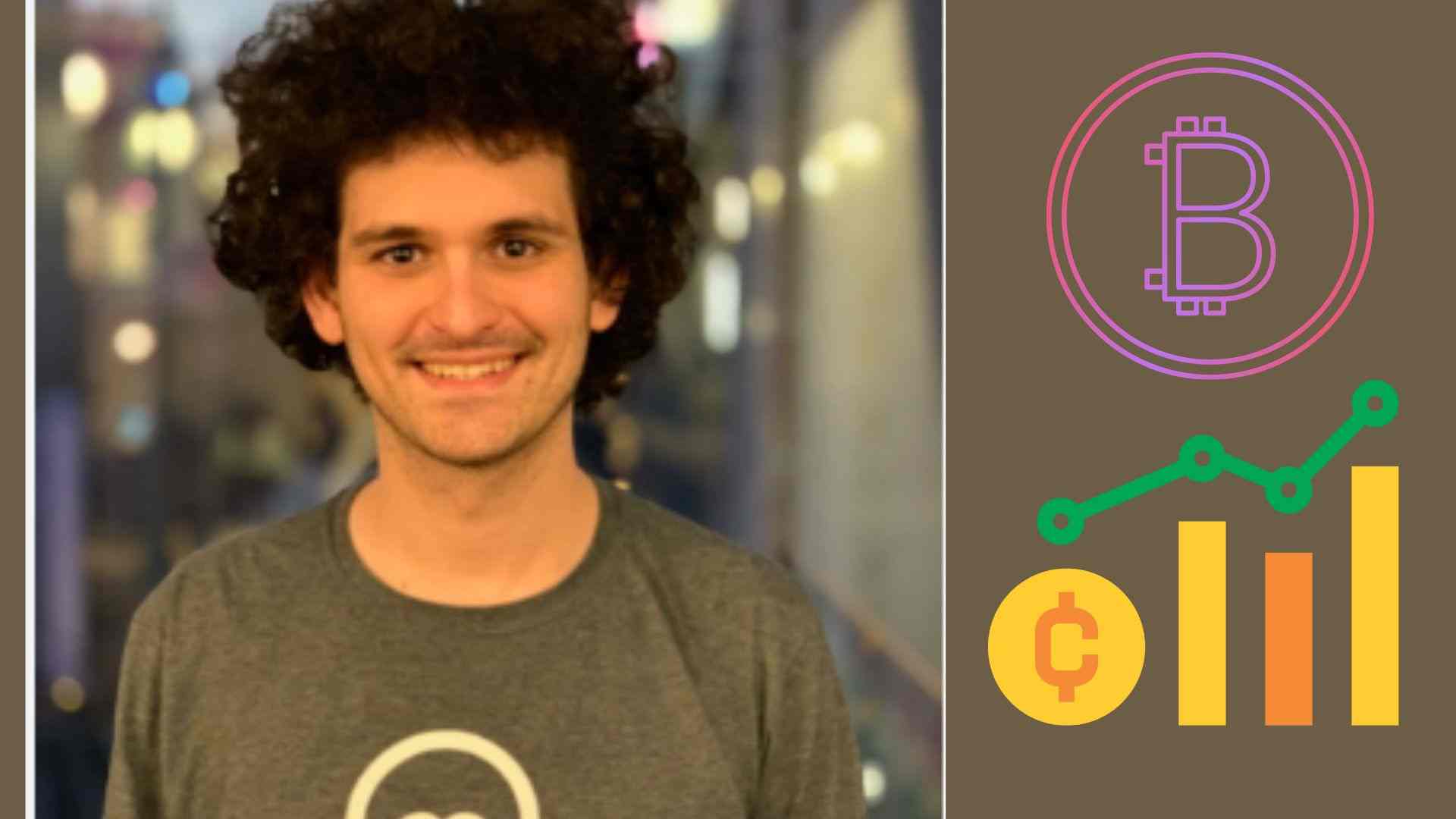

It has all come crashing back down to earth for the former ‘King of Crypto’ Sam Bankman – Fried. Last week a New York jury took just five hours to convict the former CEO of FTX of seven counts of fraud and money laundering.

Bankman-Fried’s trial captured the imagination of the public not just in the U.S but all over the world. Once the CEO of a corporation estimated to be worth $32 billion dollars, he is now set to face a jail term which has the potential to span decades.

So where did it all go wrong for this once enigmatic entrepreneur, and where does this leave the crypto market as a whole? Read on as we digest more about one of the most captivating crypto stories to ever hit our news screens.

The Rise

Despite his failures, there can be no argument that Sam Bankman-Fried has one of the most gifted minds of his generation.

The son of two Stanford academics, Bankman-Fried earned a degree from MIT before taking up a role with trading firm, Jane Street.

With money in the bank from an early successful trading career, Bankman-Fried showed off his early entrepreneurial spirit when launching Alameda Research, a crypto hedge fund. An immediate success, it was reported that at its height, Bankman-Fried was earning up to $1 million a day.

Although already hugely successful, that wasn’t enough for Bankman-Fried who would then go on to set up FTX.

Cashing in on the Crypto hype, FTX launched in 2019 and helped change the way in which people invested and brought Crypto funds. At its height it was believed that upwards of $10 billion was facilitated through FTX daily.

With FTX growing into a huge corporate entity, Bankman-Fried began to find fame. Often seen rubbing shoulders with leading political figures, FTX had a string of celebrity ambassadors and even produced a Super Bowl TV ad.

The Fall

Although the Crypto market had proved volatile, FTX and Bankman-Fried seemed immune to any market pressures and the investments continued to roll in, however the bubble would soon burst.

A 2022 investigatory report from Coindesk concluded that despite all seeming well at FTX, the company was on an extremely shaky financial footing.

With further reports that FTX were misusing customer funds, investors panicked and began withdrawing what funds they could. With the writing on the wall, the death knell was struck on November 11 with FTX filing for bankruptcy.

Upon FTX’s decline, investigations into Bankman-Fried’s activities were conducted and it was revealed that he had been using customer funds to prop up risky investments through his other company, Alameda Research.

Coupled with his illegal use of funds, it was also reported that Bankman-Fried had used customer deposits and political donations to help fund his lavish lifestyle.

With the wolves circling, Bankman-Fried was accused of seven federal charges ranging from wire fraud, securities fraud and money laundering. Despite a trial that played out over several weeks, it took a jury just five hours to hit Bankman-Fried with a guilty verdict.

Set to be sentenced in March 2025, he is facing the prospect of spending several decades behind bars.

What happens next to Crypto?

FTX wasn’t the first crypto corporation to fail and come to the attention of the authorities.

Silk Road Marketplace and MT Gox have suffered similar fates, but the exposure of Bankman Fried and the financial irregularities surrounding FTX has sharpened the spotlight on other hugely influential crypto figureheads – and has led many to doubt the future of Crypto markets.

Since being conceived back in 2009, crypto has failed to join the financial mainstream and many believe that FTX’s demise could be what pushes crypto markets back to the peripheries.

Speaking to the Financial Times, John Reed Stark, former chief of the Securities and Exchange Commission’s office of internet enforcement stated that “the industry has run its course, if it all went away tomorrow, it wouldn’t impact a single person on the planet other than the speculator.”

However, there are others that still believe cryptocurrencies can still play a major role in today’s financial ecosystem.

Despite this latest hit, there are investors that will continue to back cryptocurrencies and there is no indication that companies and online casinos that accept cryptocurrency deposits are in any danger of failing. For many, crypto represents a legitimate purchasing method and it has already shown over the last few years the resiliency to bounce back.

There are greater calls for transparency as to how the crypto market is regulated and governed and it feels like this is an essential step that needs to happen.

Many believe that crypto can still be king, but for now it certainly faces an uncertain future.